child tax credit portal says pending

Someone please explain to me why my ctc status still says pending eligibility you will not receive payments at this time. Nope but I just realized they for some reason defaulted to sending it.

Or at least go by 2019 as the portal says they would.

. I got thru to irs person. If on the IRS website in Eligibility Status of your Child Tax Credit it says Pending your eligibility has not been determined. Youre not required to file an amended return to receive advance Child Tax Credit payments.

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. How much is the child tax credit. Instead of calling it may be faster to check the.

Check the Child Tax Credit Update Portal Check the IRS Child Tax Credit Update Portal to find the status of your payments whether they are pending or processed. The Update Portal is available only on IRSgov. Child Tax Credit Update Portal.

Depending on the amendment you may no longer qualify for the Advance CTC. You will not receive advance. Those with children under the age of 6 will receive 300 per month.

As provided in this Topic E if the IRS has not processed your 2020 tax return as of the payment determination date for a monthly advance Child Tax Credit payment we will determine the amount of that advance Child Tax Credit payment based on information shown on your 2019. Your eligibility is pending. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

I hope this is accurate if you need to speak with irs its on 2-4min wait. Parents are eligible to receive 250month for each child ages 7 to 17 and 300month for each child younger than 7 years old. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

I still have not received my refund from 2020 but did receive 2019. I filed an amendment on July 12th I dont know if that changes anything but I dont see why it would. Child tax credit PENDING.

The IRS is providing eligible families with payments ranging from 250 to 300 per month. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. Also the portal provides.

Im just hoping the site hasnt updated yet. The IRS wont send you any monthly payments until it can confirm your status. My 2020 return was processed but then went under review.

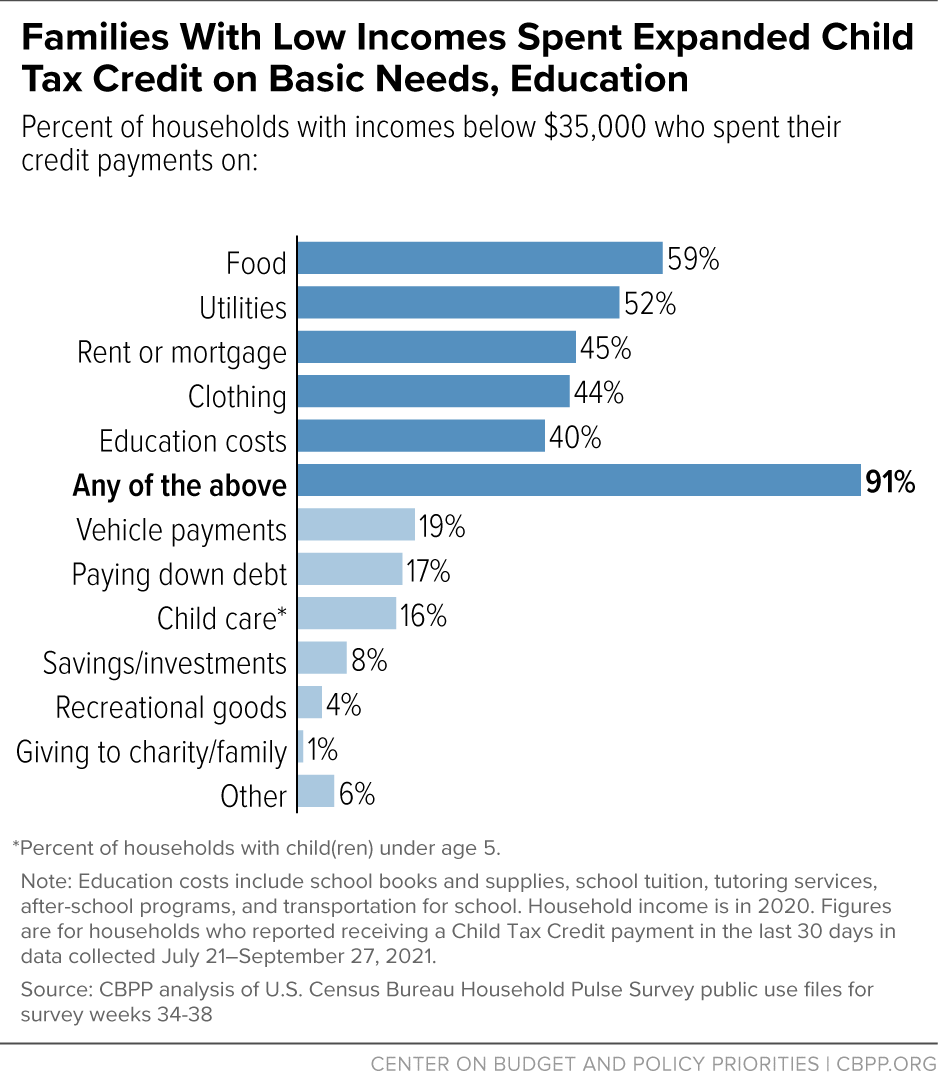

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children ages 6 through 17. To complete your 2021 tax return use the information in your online account. Do not use the Child Tax Credit Update Portal for tax filing information.

In some instances taxpayers who think they qualify for the payments may check the Child Tax Credit Update Portal and find their eligibility listing. Im listed as pending. If the portal says a payment is pending it means the IRS is still reviewing your account to.

That is the assumption of the IRS. If all else fails you can plan to claim the child tax credit when you file your 2021 taxes next year. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit. Enter Payment Info Here tool or. 866-682-7451 ext 568 I got this number from here I did speak to someone who said I should receive my return by Oct 21-22.

This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. That my case is now closed and has been worked on. Wondering if the tax credit will also be held up.

ChildTaxCredit ChildTaxCreditPortal IRS. Recipients can check the status of the monthly payment at the IRS Child Tax Credit Update Portal. I have already received my 2020 taxes months ago.

As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child. This is probably the reason. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov.

The payments will be made in the months of July August September. People complained about their accounts showing pending for the September payment on the IRS child tax credit portal after they received installments just. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

I have received every stimulus check do NOT have an amended return and fit all eligibility requirements yet Im still pending eligibility. Now just waiting on the update. So i dont know if thats considered not processed or not but regardless they should be able to see my dependents on there regardless.

You can also refer to Letter 6419. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or.

Is anyone else seeing this when they check the portal.

Step By Step Guide For Filling Of Gstr 2 Form Gst India Goods And Services Tax In India Goods And Service Tax Goods And Services Form

Form 26as How To Download Form 26as From Traces Tax Deducted At Source Income Tax Income Tax Return

The August 13 Child Tax Credit Is Pending Payment Do You Qualify

I Got My Refund Ctc Portal Updated With Payments Facebook

Need All India Itr Everify Itr V Online Income Tax Return Income Tax Tax Deducted At Source

Why Is My Eligibility Pending For Child Tax Credit Payments

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Irs Glitch Blocked Child Tax Credit Payments To Immigrant Parents The Washington Post

Irsnews On Twitter There Have Been Changes To The Child Tax Credit For 2021 And The Credit Amounts Will Increase For Many Taxpayers Learn More From Irs At Https T Co 535gr8fjvp Https T Co Bgyzn36d4v Twitter

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

File Income Tax Return Before 31st March 2019 Expires Income Tax Tax Return Income Tax Return

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

H R Block Just A Reminder The Irs Has Announced That Some Recipients Of The Advanced Child Tax Credit Will Be Receiving August Payments By Paper Check Rather Than Direct Deposit If

Missing A Child Tax Credit Payment Here S How To Track It Cnet